flow-through entity tax form

Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Michigan Enacts Flow-Through Entity Tax as Workaround to State and Local Cap February 03 2022 by Bryan Bays.

9 Facts About Pass Through Businesses

Flow-through entities are however not exempted from filing the K-1 statement with the Internal Revenue Service in the United States.

. Tax purposes and the entity is or is treated as a resident of a treaty country it will derive the item of income and may be eligible for treaty benefits. An owners income tax liability depends on his or her. Fourth quarter estimated tax payment for calendar year flow-through entities electing into the tax are due Jan.

Branches for United States Tax Withholding and. The following are all pass-through. 1 00 Schedule A Pass.

For purposes of claiming treaty benefits if an entity is fiscally transparent for US. Apportionment Calculation and Business Income Identification. Non-Electing Flow-Through Entity Income Schedule.

5376 on December 20 2021. Each pass-through entity owner reports and pays tax on their share of business income on personal tax Form 1040. Governor Whitmer signed HB.

One particular flow-through compliance concern is the existence of complex structures of related entities. The flow-through entity tax annual return is required to be filed by the last day of the third month after the end of the taxpayers tax year. Effective January 1 2021 the Michigan flow-through entity.

Entities can use Web Pay to pay for free and to ensure the payment is timely credited to their account. As signed into law by Governor Whitmer on December 20 2021 PA 135 of 2021 amends the Income Tax Act to create a flow-through entity tax in. A pass-through entity is an entity whose income loss deductions and credits flow through to members for Massachusetts tax purposes.

Generally the flow-through entity tax allows certain flow-through entities. Fiscal year flow-through entities elected into the. Tax purposes for example a disregarded entity or flow-through entity for US.

Instructions for 2021 Michigan Flow-Through Entity Annual Return Form 5773. California Senate bill proposes pass-through entity tax January 2021 Connecticut enacts responses to federal tax reform affecting corporations pass-through entities and. Flow-throughs are also a growing tax compliance concern.

653001210094 Department of Taxation and Finance IT-653 Pass-Through Entity Tax Credit Tax Law Section 606kkk 1Add column C amounts see instructions. If you own a business chances are that you not the business itself are responsible for paying taxes on the. Form W-8IMY Rev.

In December 2021 Michigan amended the Income Tax Act to enact a flow-through entity tax. 2021 PA 135 introduces Chapter 20 within Part 4 of the Michigan Income Tax Act. Instructions for 2021 Schedule for Reporting Non-electing Flow-Through Entity Income Form.

Michigan Treasury Online MTO Screenshots. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. In such case the enti.

Unlike C corporations that subjected to. Instructions for 2021 Schedule for Reporting Non-electing Flow-Through Entity Income Form 5774. Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain.

September 2016 Department of the Treasury Internal Revenue Service. A pass-through entity is any type of business that is not subject to corporate tax. For calendar filers that date is March 31.

Flow-Through Entity FTE Tax Return Form 5772. October 2021 Department of the Treasury Internal Revenue Service. Select the Services menu in the upper-left corner of the Account Summary homepage.

Retroactive to tax years beginning on or after Jan1 2021 the law allows eligible entities to. This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain. Select Corporation tax or Partnership tax then choose PTET web file from the expanded menu.

Entities can also use the Pass-Through Entity Elective Tax Payment Voucher FTB. Michigan Flow-Through Entity FTE Tax Overview.

What Is A Passthrough Entity Universal Cpa Review

An Overview Of Pass Through Businesses In The United States Tax Foundation

California Enacts Elective Pass Through Entity Tax Pte Holthouse Carlin Van Trigt Llp

Considerations For California S Pass Through Entity Tax Deloitte Us

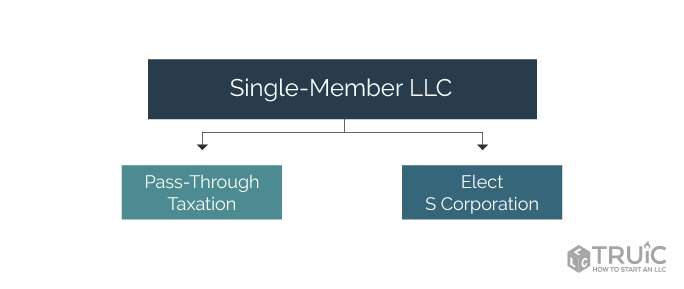

How Do I Pay Myself From My Llc Truic

What Does New York State S Pass Through Entity Tax Mean Foryou Rosenberg Chesnov

Pass Through Business Definition Taxedu Tax Foundation

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

What Is A Passthrough Entity Universal Cpa Review

Pass Through Entity Definition Examples Advantages Disadvantages

Pass Through Taxation What Small Business Owners Need To Know

A Beginner S Guide To Pass Through Entities The Blueprint

Pass Through Entities Fiduciaries Withholding Tax Return It 1140 Department Of Taxation

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

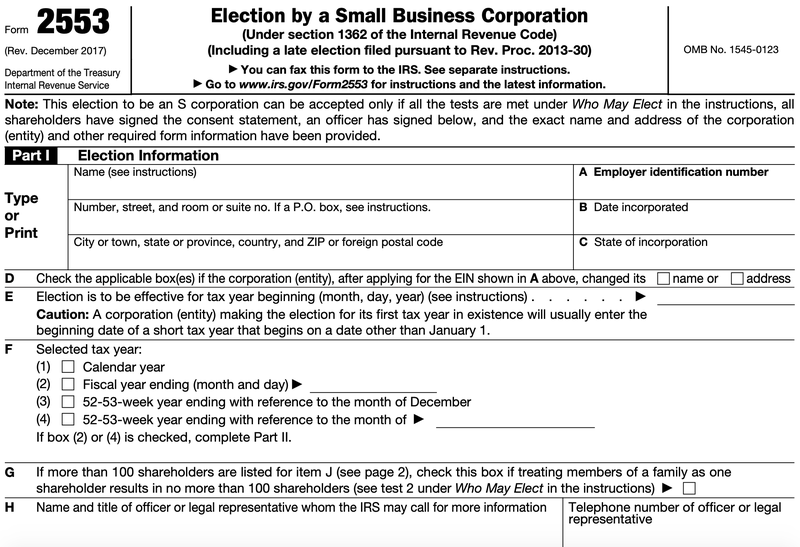

Form 1120 S U S Income Tax Return For An S Corporation Definition

Pass Through Entity Tax 101 Baker Tilly

4 Types Of Business Structures And Their Tax Implications Netsuite

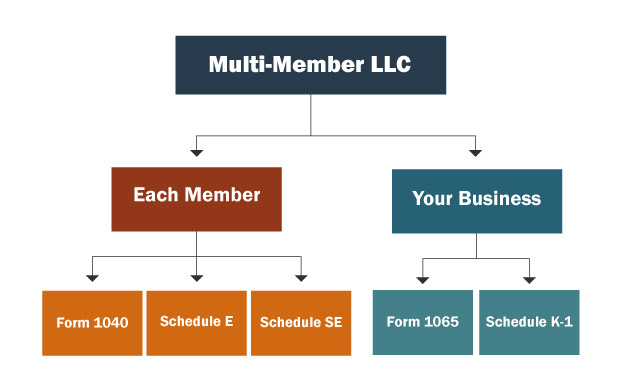

Multi Member Llc Taxes Llc Partnership Taxes